Will Xi's trip to Europe call back the investment faith in China? After Labor Day, five peaceful rest days, the stainless steel market in China could not wait to get back. On May 6th, the first trading day after the holiday, stainless steel futures quickly rose after the morning opening, reaching a high of US$2145/MT. From a global spectrum, based on the giants, stainless steel prices have kept climbing. There might not be a spike in stainless steel prices globally, but do you think the prices will at least remain in a positive range? However, the rising sea freight seems to be the last obstacle to many buyers. According to an analysis, container ship freight rates will increase to 2.5 times the original level from 2024 to 2025. If you want to catch up with Chinese stainless steel price dynamics, please keep reading the Stainless Steel Market Summary in China.

TREND|| Price Increase After Labor Day.

On the first trading day after the holiday, stainless steel futures quickly rose after the morning opening, reaching a high of US$2145/MT. Subsequently, they operated with fluctuations. By the afternoon close, the main stainless steel futures contract rose by US$14.6/MT to US$2140/MT, an increase of 0.73%; SHFE nickel first suppressed and then rose. By the afternoon close, the main nickel futures contract rose by US$152/MT to US$20545/MT, an increase of 0.76%.

300 Series: Last week, the market price of 304 rebounded and rose. As of Tuesday, the mainstream quotation of four-foot cold-rolled stainless steel 304 in Wuxi was US$2050/MT, unchanged from last week, and the hot-rolled price was US$2030/MT, up US$7 from last week.

200 Series: Last week, the market price of 201 in Wuxi remained stable. As of Tuesday, the mainstream base price of cold-rolled 201J1 in Wuxi was US$1365/MT, the mainstream base price of J2/J5 cold-rolled was US$1280/MT, and the price of five-foot hot-rolled 201J1 was US$1345/MT, all unchanged from last Tuesday.

400 Series: Last week, the quotation for cold-rolled 430 in Wuxi was around US$1240/MT-US$1245/MT; the quotation for hot-rolled 430 was around US$1135/MT, both unchanged from last week.

Overall, with decreased market transactions during the holiday, normal arrival of resources, and a slight accumulation of inventory expected Last week, the current market sentiment is cautious, and the slight increase in costs supports the high prices. Domestic macroeconomic benefits are gradually being released, real estate stocks are rising, driving the bullish sentiment of futures commodities. Short-term market price of cold-rolled 304 is expected to fluctuate.

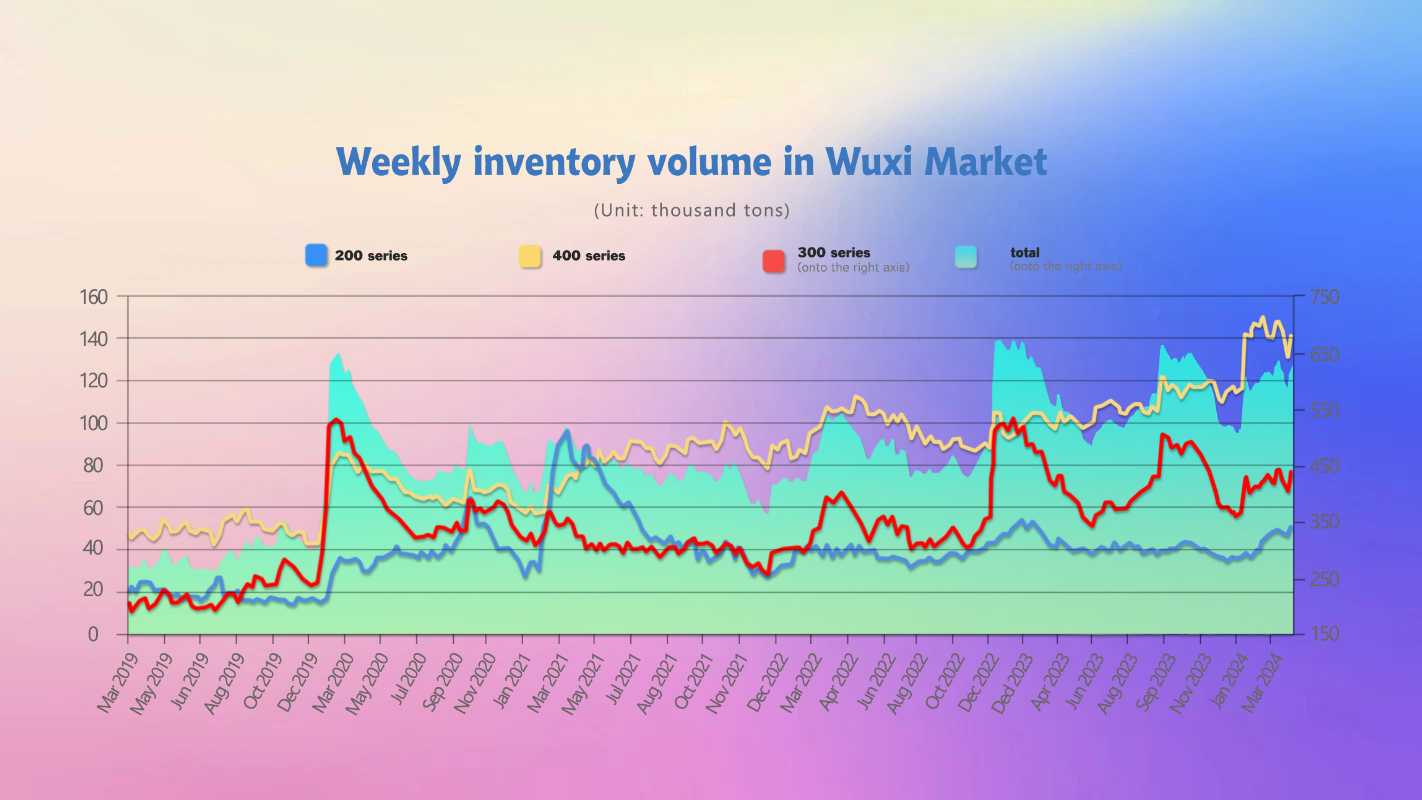

INVENTORY|| Increased by 45,400 Tons, Just Broke 600,000 Tons and Accumulated Inventory Again.

The total inventory at the Wuxi sample warehouse up by 45,404 tons to 626,883 tons (as of 7th May).

the breakdown is as followed:

200 series: 3,612 tons up to 50,028 tons,

300 Series: 32,002 tons up to 436,255 tons,

400 series: 140,600 tons up to 9,790 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| April 25th | 46,416 | 404,253 | 130,810 | 581,479 |

| May 7th | 50,028 | 436,255 | 140,600 | 626,883 |

| Difference | 3,612 | 32,002 | 9,790 | 45,404 |

300 Series: Supply pressure persists, inventory re-accumulates!

During last week, the main futures prices fluctuated and rose, and spot prices followed and ran stronger. The market arrivals increased during the Labor Day holiday, and the transaction was almost stagnant, resulting in a significant accumulation of social inventory. With the strong futures prices, basis arbitrage increased, the number of warrants increased significantly, and the cold-rolled inventory to be registered also gradually increased. Calculated based on the current raw material prices, the steel mills are in a state of small profit, and the output in May might remain high. As demand is gradually released, it is expected that the inventory will decrease next week.

200 Series: Small increase in inventory of 201 during the holiday.

During this inventory cycle, traders and downstream customers in the market opened holiday mode during the Labor Day holiday, and transactions were stagnant. The resources of steel mills arrived normally, and the social inventory increased. In recent years, with the price running steadily, terminal customers have mainly purchased rigid demand, and the output of steel mills in May might remain high. The supply pressure persists.

400 Series: Cost support is evident, and prices are running steadily.

During this inventory cycle, the inventory of both cold-rolled and hot-rolled 400 series increased due to the normal arrival of steel mills. At present, there are no overhaul plans for steel mills. It is expected that the output in May will be stable in April, and the supply pressure persists. The downstream demand has not yet improved substantially.

Sea Freight|| Global Shipping Chaos Sparks "Price Hike Wave" in Off-Season.

The global shipping industry is facing a "simultaneous crisis": two major shipping "arteries", the Suez Canal and the Panama Canal, are blocked at the same time!

Global ships cannot sail from the two canals that serve as international logistics strongholds, throwing global shipping into chaos. Due to water shortage problems that cannot be eliminated, the Panama Canal in Central America is expected to be fully lifted from navigation restrictions only in 2025. Due to the continued turmoil in the Middle East, companies have been forced to abandon the Suez Canal in Egypt. It is still impossible to predict when it will return to normal.

As for the Suez Canal, due to the continuous deterioration of the Red Sea crisis, world shipping companies have canceled their routes through the Suez Canal. The risk of escalating conflicts has increased, and there is still no sign of resuming this route. Due to the simultaneous crisis in the two canals, most ships are forced to detour around the Cape of Good Hope in Africa. This could lead to a shortage of freighters and soaring transportation costs.

The freight rate for a 40-foot container on the route from Shanghai to the east coast of the United States is US$6,652, which is 2.9 times that of the end of November 2023. During the COVID-19 pandemic, supply chain disruptions caused the freight rate for a 40-foot container to soar to about US$12,000. Although the current freight rate is lower than the peak during the pandemic, the risk of shipping disruptions has reappeared.

According to UNCTAD forecasts, due to factors such as detours, the average sailing distance of container ships and tankers will increase by 2% in 2024 compared with the previous year. If the sailing distance increases, fuel costs, labor costs and shipping time will also increase. Shipping companies hope that shippers will bear the costs, but as transportation costs are passed on to commodity prices, they will eventually affect consumers.

High freight rates are also a risk factor for countries that hope to curb inflation. According to an analysis by the International Monetary Fund, the deterioration of the Middle East situation has led to a 15% increase in oil prices, and container ship freight rates will increase to 2.5 times the original level from 2024 to 2025.