Duty on Chinese goods, do you think that is good to you? Contradictions in both economic and political environments are intensifying when the election is getting closer. Global trading is not as free as it used to be. Stainless steel is also facing the same struggle. A very immediate effect is the sea freight surge. Last week, sea freight lost control. The Shanghai Shipping Exchange's Shanghai Export Container Comprehensive Freight Index was 2305.79 points, up 18.8% from the previous week. It is said that sea freight will probably maintain the rising tendency. This will bring up your purchasing cost. From another perspective, stainless steel prices increased last week, because of the ore costs. The increasing prices of molybdenum and electrolytic manganese supported SS316L and SS430 to rise even though the slack season approaches. Steel mills' limited price strategy also protect the stainless steel prices from dropping. However, the production and inventory both increased and in May, the production is predicted to expand. Analytics think that in mid-May, the stacked inventory will cause the stainless steel prices to fluctuate. If you want to stay close to the changing market, please keep reading the Stainless Steel Market Summary In China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,180 | -4 | -0.20% |

| Foshan | 2,220 | -4 | -0.20% | ||

| Hongwang | Wuxi | 2,080 | -6 | -0.32% | |

| Foshan | 2,080 | -6 | -0.28% | ||

| 304/NO.1 | ESS | Wuxi | 2,015 | -7 | -0.37% |

| Foshan | 2,010 | -4 | -0.22% | ||

| 316L/2B | TISCO | Wuxi | 3,680 | 8 | 0.24% |

| Foshan | 3,740 | 11 | 0.31% | ||

| 316L/NO.1 | ESS | Wuxi | 3,530 | 17 | 0.50% |

| Foshan | 3,550 | -8 | -0.24% | ||

| 201J1/2B | Hongwang | Wuxi | 1,395 | 0 | 0.00% |

| Foshan | 1,390 | 5 | 0.39% | ||

| J5/2B | Hongwang | Wuxi | 1,310 | 0 | 0.00% |

| Foshan | 1,305 | 5 | 0.41% | ||

| 430/2B | TISCO | Wuxi | 1,240 | 0 | 0.00% |

| Foshan | 1,240 | 0 | 0.00% |

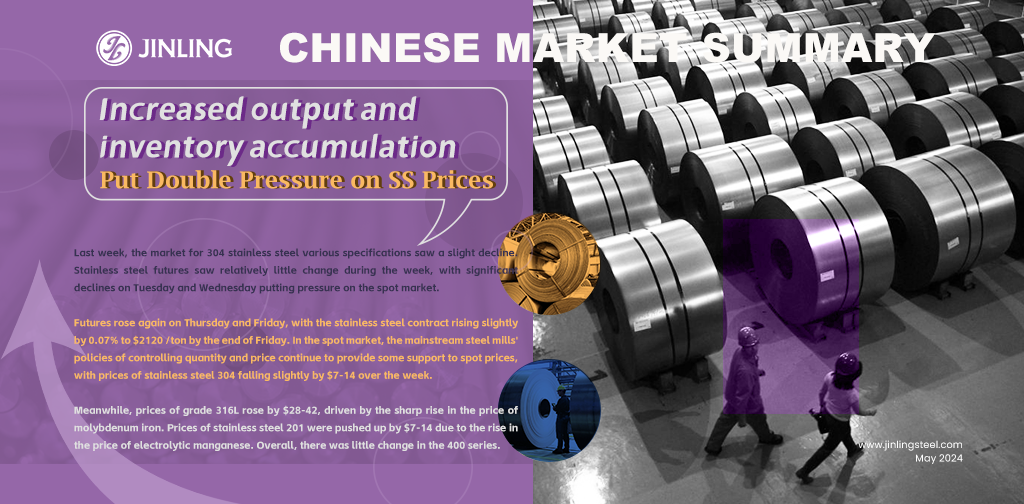

TREND|| Increased output and inventory accumulation put double pressure on stainless steel prices.

Last week, the market for 304 stainless steel various specifications saw a slight decline. Stainless steel futures saw relatively little change during the week, with significant declines on Tuesday and Wednesday putting pressure on the spot market. Futures rose again on Thursday and Friday, with the stainless steel contract rising slightly by 0.07% to $2120/ton by the end of Friday. In the spot market, the mainstream steel mills' policies of controlling quantity and price continue to provide some support to spot prices, with prices of stainless steel 304 falling slightly by $7-14 over the week. Meanwhile, prices of grade 316L rose by $28-42, driven by the sharp rise in the price of molybdenum iron. Prices of stainless steel 201 were pushed up by $7-14 due to the rise in the price of electrolytic manganese. Overall, there was little change in the 400 series.

300 series: Inventory accumulation suppresses price increases.

Last week, the price of stainless steel 304 weakened slightly. By Friday, the mainstream base price of four-foot cold-rolled 304 in Wuxi fell to $2023 /ton, down $14 from the holiday period; the price of hot-rolled stainless steel fell to $2015 /ton, down $7 from the holiday period. The market fluctuated within a range Last week, with spot prices following suit. With stagnant trading in the holiday market and normal arrivals, there was a significant accumulation of inventory Last week, suppressing spot price increases. The rapid rise in prices on the first day after the holiday boosted market sentiment, with traders holding steady prices and speculative buying from end-users increasing. In the latter half of the week, prices rebounded slightly, with steel mills raising prices at the opening, but market buying sentiment remained cautious, with demand-driven purchasing being the main trend. The continuous rise in the price of molybdenum iron drove up the price of 316L.

200 series: Steel mill opening prices up by $100.

Last week, the price of 201 spot in Wuxi was mainly stable. By the end of Friday, the mainstream base price of 201J1 cold-rolled had risen to $1375 /ton; the base price of J2/J5 cold-rolled had risen to $1290 /ton; both up by $7 /ton from last week; the mainstream price of hot-rolled had risen to $1345 /ton. In the first half of the week, prices continued to fall, with market sentiment falling, and the price of 201 followed suit, dropping by $7 /ton to ensure shipments. In the latter half of the week, Tsingshan’s Hongwang opened with a price increase, and futures rebounded, with Tsingshan’s 1traders following suit, but actual transactions were not ideal.

400 series: Prices remain stable.

Last week, TISCO’s cold-rolled 430 guide price was $1470 /ton, and JISCO's guide price was $1600 /ton, both unchanged from last week. The mainstream offer price for cold-rolled stainless steel 430 in the Wuxi market was $1240-1245 /ton, and the offer price for hot-rolled 430 was $1135 /ton, both remained the same from last week.

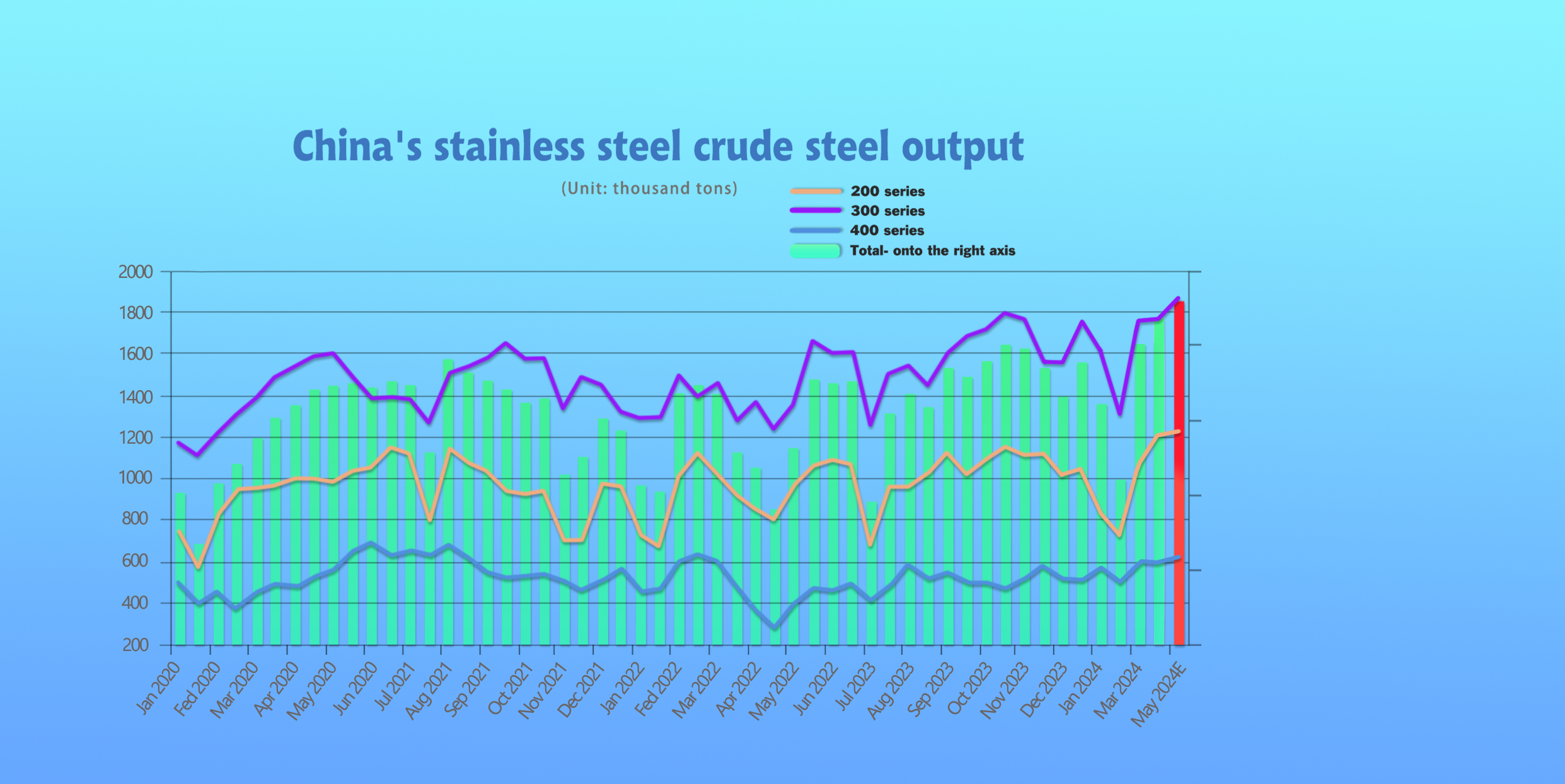

INVENTORY|| Output increased by 160,000 tons in April, and high output will be maintained in May.

In April, as prices rose, steel mills turned losses into profits, maintained high-level production, and increased output month-on-month (with a larger increase in the 200 series). Demand gradually warmed up, and the price increase stimulated consumer buying sentiment, especially the active replenishment of shorts, and social inventory decreased within the month.

According to the research and statistics, the output of crude steel by large-scale stainless steel enterprises in China in April 2024 was 3.5694 million tons, an increase of 161,800 tons month-on-month, an increase of 4.75%; an increase of 585,400 tons year-on-year, an increase of 19.62%.

The output of each series in April increased, and the details of the output of each series are as follows:

The output of the 200 series was 1.2 million tons, an increase of 136,600 tons month-on-month, an increase of 12.82%, an increase of 178,700 tons year-on-year, and an increase of 17.46%.

The output of the 300 series was 1.7682 million tons, an increase of 1.46 tons month-on-month, an increase of 0.83%, an increase of 324,600 tons year-on-year, and an increase of 22.49%.

The output of the 400 series was 599,100 tons, an increase of 10,600 tons month-on-month, an increase of 1.81%, an increase of 82,000 tons year-on-year, and an increase of 15.86%.

300 Series: Supply pressure persists.

Inventory of the 300 series in the Wuxi market increased by 32,000 tons this week (cold-rolled increased by 20,000 tons and hot-rolled increased by 12,000 tons) to 436,300 tons. Last week, the main futures prices fluctuated and rose, and spot prices followed and ran stronger. The market arrivals increased during the May Day holiday, and the transaction was almost stagnant, resulting in a significant accumulation of social inventory. With the strong futures prices, the output in May may remain high.

200 Series: Inventory increases by 45,000 tons, and the output in May remains high.

The total inventory of the sample warehouses in Wuxi this period increased by 45,400 tons to 626,900 tons compared with the previous period. Among them, the inventory of the 200 series increased by 0.36 million tons to 5 million tons, and both cold-rolled and hot-rolled increased. Among them, the cold-rolled inventory increased by 2207 tons, an increase of 6.00%; the hot-rolled inventory increased by 1405 tons, an increase of 14.56%. In recent years, with the price running steadily, terminal customers have mainly purchased rigid demand, the output of steel mills in May remains high, and the supply pressure persists.

400 Series: High-level inventory accumulation.

The inventory of the 400 series in the Wuxi market increased by 0.98 million tons this week to 140,600 tons, and the inventory of both cold-rolled and hot-rolled 400 series increased, mainly 430 cold-rolled. At present, there are no overhaul plans for steel mills. It is expected that the output in May will remain stable, and the supply pressure persists.

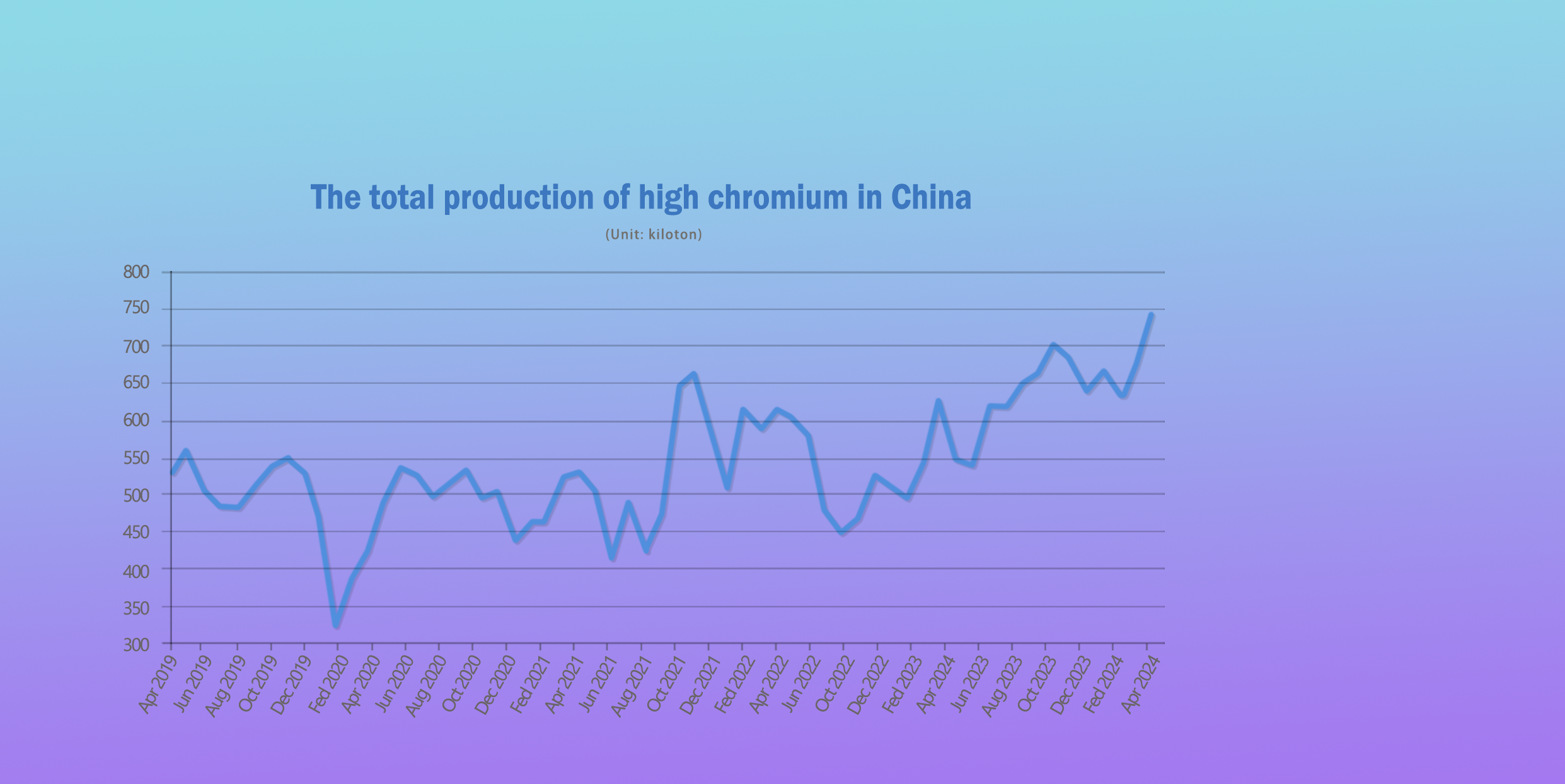

RAW MATERIAL|| High-carbon chromium output expected to increase, prices struggle to rise.

The mainstream EXW price of high-carbon ferrochrome is in the range of $1315-1345 /50 reference ton, unchanged from last week. The procurement prices for high-carbon ferrochrome by Taigang and Baosteel Desheng for May 2024 were finalized at $1345 /50 reference ton and $1375 /50 reference ton, unchanged from the previous month. In recent days, the price of coke has continued to rise, while the price of ferrochrome ore remains relatively firm, leading to an increase in the comprehensive production cost of high-ferrochrome materials and strengthening cost support.

However, considering the supply side, the future outlook for high-ferrochrome materials is not optimistic. According to statistics, in April 2024, domestic production of high-carbon ferrochrome iron surged to a new high in several years.

Among them, major producing regions such as Inner Mongolia, Guizhou, and Guangxi saw significant increases, while regions like Sichuan, Hunan, and Shanxi saw smaller increases. The main influencing factor was a significant increase of $70 in the steel bidding price for high-carbon ferrochrome iron in April, leading to high enthusiasm for factory production. Additionally, the release of capacity from newly commissioned projects in the previous period led to a rapid increase in high-ferrochrome production.

In April 2024, the total production of high-carbon ferrochrome iron in several major producing regions nationwide reached 743,000 tons, an increase of approximately 68,500 tons, or 10.16%, compared to the previous month.

In May 2024, the bidding procurement prices for high-carbon ferrochrome iron by Taigang and Tsinngshan remained unchanged from the previous month, better than expected. In addition, with the expected reduction in electricity prices in the southern producing regions in May, the pace of resumption of production in high-ferrochrome factories in the southern region will further accelerate. It is expected that the overall domestic production of high-ferrochrome materials will continue to increase in May, which is not conducive to price increases.

Overall, although cost support is relatively strong in the short term, the further acceleration of the resumption of production in high-ferrochrome factories in the southern region may lead to an increase in high-ferrochrome production in the later period. The situation where supply exceeds demand in the high-ferrochrome market may gradually emerge, and the upward pressure on high-ferrochrome prices remains weak, with stabilization being the predominant trend.

SUMMARY|| Stainless steel enters the off-season for sales, testing future demand with high factory output.

Stainless steel prices fluctuated this week, with moderate trading atmosphere and overall average downstream digestion capacity. Social inventories have slightly rebounded, while raw material prices remain firm, and factory output remains high. Expect stainless steel to continue fluctuating in the future.

300 Series: Current raw material cost support remains, with improved factory profits and a strong stance on supporting prices. However, post-holiday inventory accumulation has emerged in the market, coupled with high supply pressure from factories in April-May, resulting in oversupply and pressure on stainless steel spot prices. Short-term expectations are for 304 cold-rolled spot prices to fluctuate, with attention to factory production schedules and inventory digestion.

200 Series: As we enter May, factory production plans continue to remain high, with market supply pressure still present. End customers mainly engage in just-in-time purchasing, and social inventories remain relatively high. The continuous rise in raw material prices also provides support for 201 prices. Short-term expectations are for spot prices of 201 to mainly fluctuate.

400 Series: With stronger support from raw material costs and improved factory profits, the cost of 430 cold-rolled steel is currently at $1270/ton, and factories still incur slight losses, but the stance on supporting prices is strong. Post-holiday trading atmosphere in the Wuxi market has improved slightly, and market demand may further release. Given that inventories of the 400 series are currently high, short-term expectations are for 430 prices to remain weak and stable.

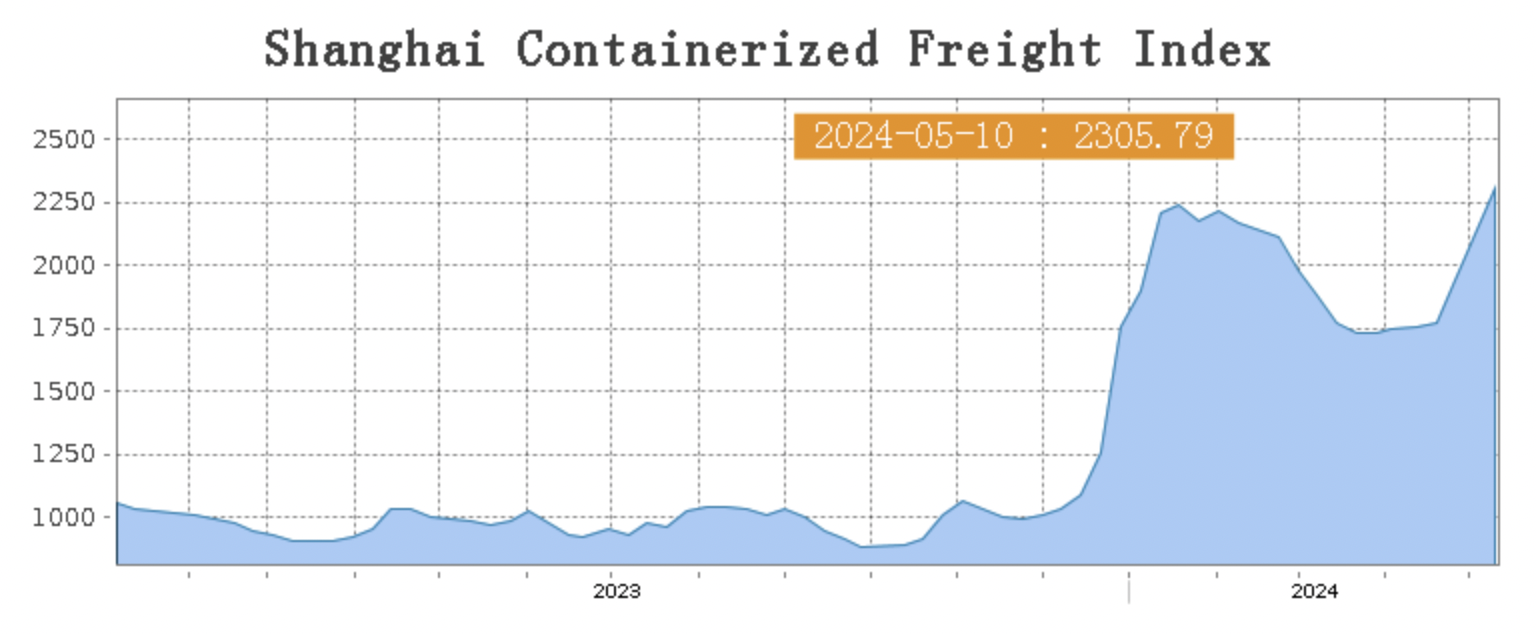

SEA FREIGHT|| Freight rates rise as post-holiday market sentiment improves.

This week, the China export container shipping market continued its good performance after the short holiday, with ocean route freight rates continuing to rise, driving up the composite index. On May 10th, the Shanghai Shipping Exchange's Shanghai Export Container Comprehensive Freight Index was 2305.79 points, up 18.8% from the previous period.

Europe/ Mediterranean:

According to data released by the European Statistical Office, the eurozone retail sales index rose 0.8% month-on-month in March, higher than the previous value and market expectations, and the highest level since January 2023. This represents a steady improvement in consumer confidence. The local transportation market demand remains at a high level, the supply and demand relationship is good, and major shipping companies are pushing for price increases, resulting in a significant increase in market freight rates.

On May 10th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2,869/TEU, a significant increase of 24.7% from the previous period. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3,915/TEU, reporting a 21.0% surge.

North America:

According to data released by the General Administration of Customs, China's total exports to the United States in the first four months of 2024 reached 1.08 trillion yuan, a year-on-year increase of 2.4%, with a trade surplus of 692.41 billion yuan, a year-on-year increase of 5.4%, providing long-term support for transportation demand on the North America route. Transportation demand has recovered well after the holidays, the supply and demand fundamentals are solid, and major shipping companies continue to push for freight rate increases, and spot market booking prices continue to rise. On May10th, the market freight rate for export from Shanghai Port to the main ports in West and East America (sea freight and sea freight surcharges) were US$4,393/FEU and US$5,562/FEU, respectively, up 22.0% and 19.3% from the previous period.

The Persian Gulf and the Red Sea:

On May 10th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 3.8% from last week's posted US$2124/TEU.

Australia/ New Zealand:

On May 10th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1169/TEU, a 25.8% jump from the previous week.

South America:

On May 10th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$5461/TEU, an 18.1% growth from the previous week.